One of the biggest improvements that GST has brought in is the way businesses can manage their tax burden with the concept of claiming Input Tax. In simple words, Input Tax Credit means reducing the taxes paid on inputs from taxes to be paid on output. Hence, if you are buying from us on Industrybuying for business purpose, i.e. either for using the goods as an input or selling the goods to end consumers, the effective cost of buying the goods from us is vastly reduced due to the input tax one can claim on the goods bought. Our GSTIN is present on every sales invoice for your reference.

Input Tax Credit

GST mainly brings in a smooth flow of input credit across the supply chain (from the manufacturer to the ultimate consumer) and throughout the country. By the employment of GST Input Tax Credit on the supply of goods and services, the amount of tax payable can be reduced significantly leading to the procurement of profit. Below are some frequently asked questions regarding Input Tax Credit (ITC).

What is ITC (Input Tax Credit)?

Earlier there was Value Added Tax, service tax and exercise duty on products but now there is no other tax on products except GST. When the Goods Service Tax is charged to a tax payable person the tax is known as Input Tax. To be clear it means when you have to pay a tax on any output, you can reduce the tax as you have already paid tax on its input.

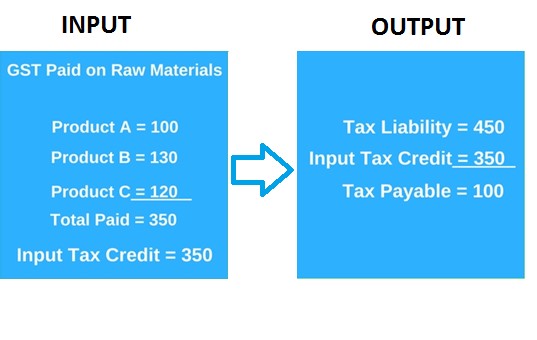

Let’s take an example to understand. If you have availed separate input products A, B and C and have paid Rupees 100, 130 and 120 respectively for each part. The total liability raised after the output product is Rupees 450, then you can apply for the Input tax and get your tax reduced to Rs.100 (as 350 rupees were already paid for input products)

So, it is clear that now you do not need to pay the whole sum of Rupees 350 rather on a whole the payable tax gets reduced to Rupees 100.

ITC has emerged out to be the backbone of GST and hence is benefitting a lot of consumers and manufacturers all across the country.

Types of Input Tax Credit under GST-

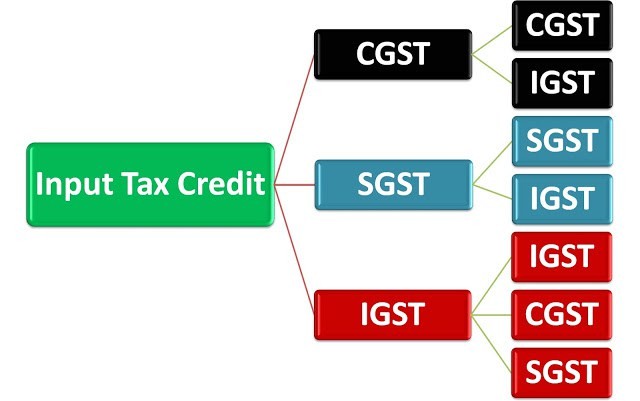

#1)CGST (Central Goods and Service Tax)

Central Goods Service Tax is the tax levied by the central government. The central government can single-handedly avail the benefits of implication of this tax.

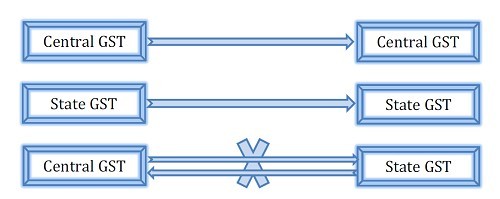

#2)SGST (State Goods and Service Tax)

State Goods Service Tax is imposed by the state government in which the state government can utilize the benefits in a Taxable transaction. CGST and SGST cannot be cross utilized in a taxable transaction.

#3)IGST (Integrated Goods and Service Tax)

Integrated Goods Service Tax is also levied by the Central government but it is for interstate supply rest are intrastate supply. IGST gets shared between Central and State governments.

Now one can easily purchase and sell the products all across the country with the same structure of rates after the implication of Input tax under GST.

How to reduce the tax under GST?

The tax can only be reduced under a single condition. The consumer must be aware of his rights. This means one should know how to get the input and while procurement what amount should be paid on each input so that it becomes easy to find the reduction in tax when calculating the output. Input tax has led to reduction of all other taxes.

How to avail Input tax?

- It can be availed by a taxable person who applies for it in a particular manner.

- It is to be availed within a time period and in a proper method. Real receipts of input can be extremely helpful.

- You can avail it after the final lot is received so it is not necessary to pay input tax in between the process.

What can be claimed under ITC?

- Integrated Service Tax can be claimed when everything is regarding the business purpose.

- For personal purposes, exempt supplies or any other purposes it cannot be claimed.

When you can avail Input Tax Credit?

- If one has paid tax in GST, then only he is eligible to avail it.

- If you have already paid the tax for input and also have to pay taxes on the final output, then it becomes a boon to avail of this input tax and procures a heavy exemption.

What is the process for the reversal of Input Tax Credit (ITC)?

- If the invoice is not paid within 180 days when an issue is raised, then the tax is reversed.

- If a credit note is issued to an ISD dealer then reversal takes place.

- If business and personal use segregations are not proper, then also reversal is done.

How to get maximum growth with savings by ITC?

By raising this input tax, you can get appropriate growth and savings for your business as you will be exempted from paying a large amount of tax repeatedly which you have already paid while procuring the inputs which could lead to maximization of profits.

Average Rating