Benefits of GST Bill in India

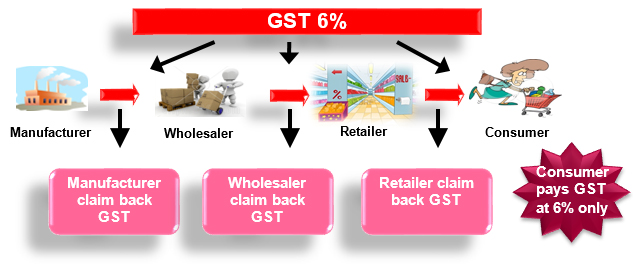

There are plenty of advantages of GST Bill India for consumers, sellers as well as for the government. While the basic assumption is that of a sorted tax structure one cannot ignore the tangential benefits once the GST bill in implemented in its full force. In this article, we will take a look at why GST tax bill is regarded as a revolutionary Tax bill that will boost economic growth and will be the catalyst in ease of doing business. Here is how different contributing parties in an economic trade stand to gain with the implementation of GST:-

Impact of GST bill on Industries/Sellers

The backbone of the GST act is the sophisticated IT system to ensure smooth registrations, returns, payments etc. Anyone looking for respective information or compliance can simply log onto their computers and be done with the formalities.

At present, different states across the country levy different taxes on the supply and the movement of the goods within the state and outside it. With the implementation of GST tax policy, which is rightly referred to as One Nation, One Tax policy, Sellers do not have to get entangled into the cascaded tax policy structure rather adhere to a single tax structure which will be implemented all across the country.

All in all, Goods and Services tax bill is going to promote ease of doing business which will initiate competitiveness in the market.

How will it boost revenue generation for Government?

A total of about 15 taxes levied by State and Central government are to be replaced by the GST tax bill India. The various components of GST bill i.e. CGST, IGST and SGST will be regulated with the help of an end-to-end IT system. It makes it easy for the State and Central government to monitor and administer the taxes levied under GST with the help of a robust IT system.

One of the major drawbacks of the existing tax structure is the poor revenue efficiency. With a robust IT system, the cost of tax collections is expected to come down.

Reduced cost price is just one of the GST benefits for Consumers

It is not only the businesses which suffer due to complications of the present tax structure. The customers also end up on the wrong side. The end consumer who purchases a product is unaware of the number or the type of taxes levied upon a product. Hence, ends up paying unwarranted money on the purchase.

With the implementation of the GST bill India, a transparent tax structure will yield necessary information to the end customers. Also, the with higher efficiency gains and preventive measures to eliminate leakages one can expect reduced tax burden on many commodities which in the end is going to benefit the customer.

How does B2B e-commerce play a crucial role in the success of GST (Goods and Services Tax)?

One of the prominent aspects of the GST Bill India is its ability to transform the Indian economy into a Digital medium. All the forms, policy paper, from registration to filing can be done online. When all the focus is on Digitization, needless to say, B2B e-commerce cannot remain in the background. Industrybuying, for one, is already registered in all the states.

Sellers looking to enhance their online presence and be directed to over 2 Million Business Customers per Month stand to gain a lot by aligning with Industrybuying.com. It is the ease of doing business which will only do wonders for a buyer or seller on an e-commerce portal. Industrybuying is one of the leading B2B e-commerce websites of India.

The company gives a chance to all the businesses small or big to avail fully GST compliant services without any need to get registered individually. Industrybuying has a PAN India reach and delivers to over 15,000 pin-codes all across India. The impact of GST on e-commerce is going to fuel the online competition among the retailers and if you are looking to be part of the change that is going to fuel Indian economy don’t wait up and be a part of revolution by partnering with Industrybuying.

Average Rating